This Native American Heritage Month (Nov.) and Native American Heritage Day (Nov. 29th), we are honoring the diverse languages, traditions, and stories of Native American and Alaska Native communities and taking time to ensure we are respectful of their histories and contributions.

Native American communities often have a strong sense of values and spirituality. According to Native Hope, “The

life and oral traditions of Native cultures in North America offer rich and ancient spiritual insight.... They thought of all of life—every task, every ceremony, every community gathering, every relationship with humans and non-human things—as

part of a larger sacred story. The spiritual and the physical are not separate, but interwoven and constantly interacting with each other.... This has enormous significance for the way that Native Americans live in modern society, and it helps

explain the tension many Natives experience as they try to live in the ancient beliefs of their

peoples while also living in today’s Western-dominated culture.”

Modern-day financial support and advice can sometimes be antithetical to Native values with some banks and institutions focused more on results than overall wellbeing. However, that doesn’t have to be the case. In this blog post, we will acknowledge

existing financial barriers for Native Americans, discuss how Native Americans might be able to honor their traditional values when considering modern money management options, and provide resources for support.

Financial Barriers for Native Americans

While there are hundreds of different Native American tribes and nations with their own unique cultures, one commonality they all share is the history of colonization, forced relocation, genocide, and ongoing cultural erasure. One of the long-lasting

effects of this shared history and oppression is that Native American communities face some of the most significant barriers to wealth in the U.S. According to BECU, the average Native American household has just 8 cents of wealth for every dollar of wealth the average white American household has, and Native Americans have the highest

national poverty rate at 25.4% compared to 8% for white Americans.

In addition to historical barriers, there are a number of ongoing challenges compounding these effects, including lack of access to financial institutions and resources – Native American households represent the lowest rate of banked households in the country, and those who live on reservations are an average of 12.2 miles from the nearest bank or credit union. This lack of access,

in addition to a very understandable lack of trust in banks, has contributed to limited financial education regarding modern-day money management.

By providing insight into how Native values can be upheld in a modern financial system, we hope to empower those who are looking for opportunities to expand their wealth without compromising their values and traditions.

Honoring Community in Choosing a Financial Institution

One of the most important Native American values, shared by many Indigenous communities, is the emphasis that is placed on community and collective wellbeing. According to Native Tribe Info, this fosters a strong sense of belonging and support, where individuals are interconnected and responsible for each other’s welfare.

Here are a couple financial tips to support ideas of community:

Choose a CDFI and/or credit union: Community Development Financial Institutions (CDFIs) are mission-driven institutions focused on providing financial services, affordable credit, and development in underrepresented and economically

distressed communities. Additionally, some CDFIs are also credit unions (like Self-Help), which are inherently focused on community through not-for-profit member ownership. They are known for reinvesting earnings back into the community

to support sustainable growth and provide accessible financial services as well as financial education. Because you are a part owner when you are a member of a credit union, you earn voting rights (regardless of your account size) and

any profits are given back to the credit union’s members and their community through various products and services.

Include community needs in your financial plan: When creating a financial plan, you may want to include more community-oriented expenses. Make sure to be open and realistic about any community needs that you may want to take into account when considering how you’re saving and spending – this could include setting aside funds for community contributions or including family needs in your plans.

Emphasizing Harmony and Balance in Savings Habits

Native American cultures often have lived in balance with the ecosystems around them and have gained a strong understanding of the value of harmony in all aspects of life. This deep care for harmony and balance is one that can easily be applied to

understanding savings habits.

When determining how to save, it can be an intricate dance trying to figure out how to balance current needs with future goals, much like the balance of working in harmony with the earth and within communities.

Here are a couple financial tips to achieve harmony and balance:

Create a framework for your expenses: Create a balance between expenses and financial goals by following a general guideline like the 50/30/20 framework. In this framework, you would ideally spend 50% of your monthly take-home

income on needs, 30% on wants, and 20% on savings and debt repayment. The idea is to have the flexibility to spend on what you want and need now while also preparing for the future to create a sense of financial wellness.

Work with a financial coach to establish savings habits: Many CDFIs and credit unions offer free financial coaching

to members and can support you in creating a more balanced financial plan through savings habits, debt management, and support for your financial goals. Financial coaches are here to work with you and your unique needs, and they can

help you come up with a personalized action plan that centers your values. Finding balance in your finances is key to aligning yourself with your beliefs and goals while also relieving unnecessary stress.

Supporting Sustainability through Investment

Environmental stewardship and sustainability are often central to Native American wisdom, which includes a deep respect for the earth and the interconnectedness of all living things. In this wisdom, there is an emphasis on resource management and

moving toward a more sustainable future that can apply to how we think about financial investment, both for the world and for ourselves.

Not only can investments align with your values of creating a sustainable future for everyone, but investing responsibly can also help you to create a more sustainable future for yourself and your community. Due to inflation, when you don’t

invest your savings in some way, it loses value. The best thing you can do for yourself and those who depend on you is make sure that your money will be sustainable.

Here are a couple tips in support of a sustainable future:

Invest responsibly in environmental and community sustainability: Once you’ve worked with a financial coach and determined how much you are comfortable investing, make investment choices that align with your values.

Consider investing in Native-owned businesses, tribal economic development, conservation, or environmental work. By making informed decisions on your investments, you can support the organizations and causes that you care about while also

setting yourself up for a sustainable financial future.

Make sure your financial sustainability includes your future: Planning for retirement is necessary in creating a sustainable future for yourself (and your loved ones), but it can be overwhelming, and there are a lot of things to consider. Investing too much into your retirement fund now

could potentially leave you struggling if a big expense comes up, but if you don't invest enough, you might not be taking full advantage of compounding returns and employer matches. For support in figuring out how to create a sustainable

post-retirement future that works for you, explore our step-by-step guide to saving for retirement to get started.

Take a Holistic Approach to Financial Wellbeing

Many Native American cultures value mindfulness and deep connection to gain self-awareness and understand the impact we each have on the world. Taking a holistic approach to anything in life can help us understand how everything works together to

lead us to a more whole and informed relationship with ourselves and our actions.

By taking a holistic approach to financial wellbeing, we can be purposeful in our decisions and actions when it comes to money because money becomes not just a means to an end, but a tool to support our values and ways of life.

Here are a couple tips in support of a holistic approach to money:

- Consider your money story: A money story is a personal narrative about money that includes your personal beliefs, thoughts, and feelings about money that affect your financial behaviors. Identifying your own money story and working to reshape it is crucial to developing sustainable habits and informed decision-making.

- Start to uncover your money story by

asking yourself these questions:

- What was your relationship to money growing up?

- What are your first memories of money? Were they positive or negative?

- What money lessons did you learn from your parents or parental figures?

- What attitudes about money did you observe within your community?

- What impact have your own beliefs had on money?

- Once you’ve answered these questions, start to consider your current relationship with money and what beliefs you may need to reshape to support more beneficial money habits.

- Consider how non-monetary assets play a role in your wealth: Non-monetary assets are a crucial part of understanding your financial wellness as a whole. They can include obvious assets like owned property in the form of land or a

car, but they can also include things like the value of goods, skills, and personal development that you’ve worked to establish or grow. These things could potentially be exchanged for monetary value in some way, shape, or form, but they

also hold value in the personal richness of our lives and the social economy of relationship- and community-building. They could be important in understanding how and why you invest your time, energy, and money because they are components of a

life fully lived.

Financial Resources for Native Americans

As you determine how to approach your finances in a way that honors your values and traditions, here are a few resources that may be helpful on your journey:

Self-Help Land Acknowledgement

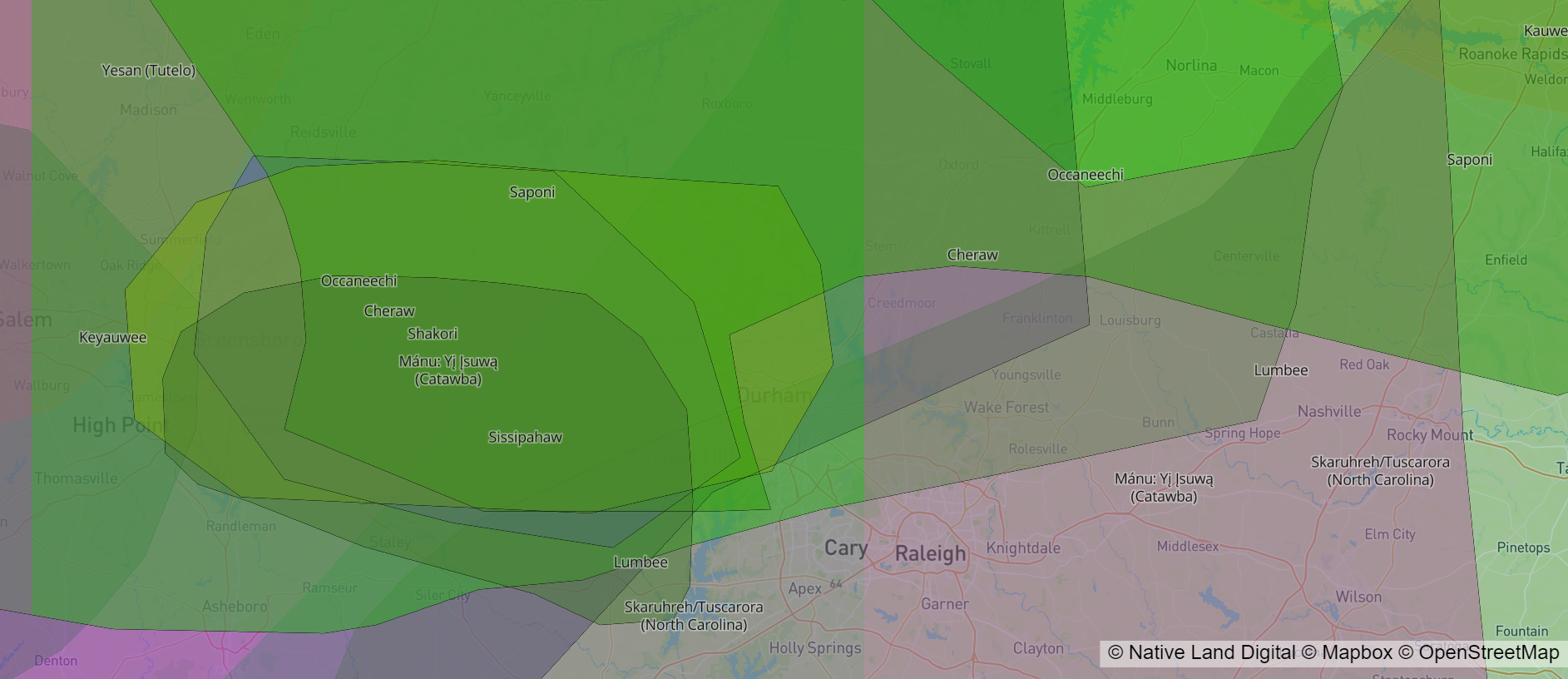

Self-Help's headquarters is located in colonial Durham, North Carolina. We respectfully acknowledge that the land our headquarters is on today is the traditional and ancestral homelands of the Tuscarora, Occaneechi, Cheraw, Shakori, and Catawba

peoples. According to the Museum of Durham History, Durham is also thought to be the site of

an ancient Native American village called Adshusheer, where The Great Indian Trading Path passed through.

This Map area from Native Land Digital shows the various Native communities that once had a presence in the present-day Durham region.