Big financial goals can be exciting and daunting at the same time, and it can be difficult to know where to start. While your first thought might be to start a budget, without the right perspective, it can easily become a source of frustration. Making sure your spending habits fit with your goals before you attempt to budget can help you to set yourself up for success along your financial journey

Why budgeting might not be the best place to start

It can feel overwhelming to try to fit your unique financial situation to a rigid budget. Bad experiences can also leave you feeling deflated and discouraged, and you might end up abandoning your goals.

Another reason why budgets sometimes fail is that for many of us, our finances are uncharted territory – our cashflow isn’t always the same every month, and unexpected expenses, if we’re not careful, can throw off our calculations.

Instead, our financial capability coaches recommend first taking a few steps back and arming yourself with as much knowledge about yourself and your finances as possible.

When you’re familiar with your own financial behaviors and habits, you’ll maximize the benefits of any steps you decide to take. The knowledge of exactly where your money goes each month can help you to feel more in control of your money and your choices.

Determine your financial goals and values

Do you want to save for a large purchase, get out of debt, or build a nest egg to provide financial freedom in your retirement? Asking yourself these kinds of questions first can help you understand what your financial goals and values are, and in

turn help you to reshape your spending and savings habits. As you think a little deeper about what you’re looking to get from your financial journey—whether it’s a single purchase or an entire lifestyle change—your values

and perspective might change, too.

Get a bird’s-eye view of your money

Once you’ve done some introspection, it’s time to start collect as much information as possible about your cashflow and spending habits. You can start by reviewing any financial records, like receipts and bank and credit card statements.

If you’re a freelancer or work more than one job, be sure to gather records from all your income sources.

You can also use automated tools, spreadsheets, and apps to track your purchases. These can be a convenient way to better understand how you’re using your income, and they also eliminate a lot of time-consuming calculations and receipt-tracking.

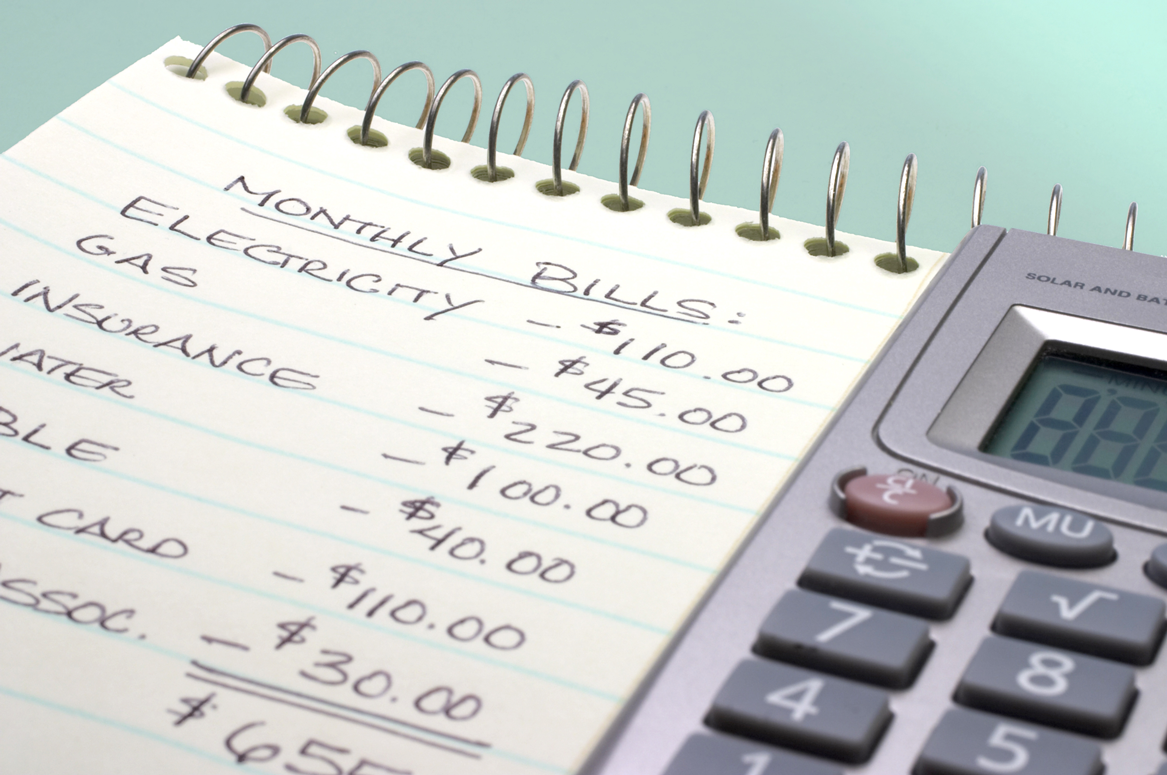

For others, taking the time to record your spending by hand in a journal can be an exercise in mindfulness. Making a daily or weekly practice of

writing down in detail what you’ve spent and where can make you more thoughtful about your spending, and it might even help you correct some impulsive spending habits.

Take stock — figure out how your spending aligns with your goals

Once you decide on a method to track and plan your savings, you’ll be better positioned to determine how to work toward your goal. It should also help you determine whether, at the end of each period, you’re in an overall deficit or a

surplus. Most important, you’ll be able to see where your current spending doesn’t fit with your larger financial goals.

Take action, but don’t be afraid to start small

From here, you can tackle one category at a time and find ways to channel overspending into savings. Instead of an overall budget, you can divide and conquer your expenses where you see misalignments with your goals.

For example, if you notice a lot of your money going toward restaurant meals or entertainment, you might focus on finding alternatives like learning to cook at home and visiting local parks, libraries and free museums. If your spending on utilities

seems high, you could consider finding simple ways to lower your energy consumption or make energy efficiency updates to your home.

If you find yourself with a surplus, you can now decide where to allocate it — this is where your hard work of aligning your spending with your goals comes into play. Consider dividing your surplus funds into three important buckets: your goals,

an emergency fund, and paying down your debts.

Congratulate yourself for completing a critical first step

No matter how the results of your spending plan turn out initially, you should feel a sense of accomplishment from having completed this important financial milestone. Whether you end up with a surplus or have more work to do to build your savings, simply

knowing where you stand financially means you’re well on your way to achieving your goal.

Consider making your money grow for the future and for your community

Once your planning efforts have paid off with strong savings and healthy spending habits, consider investing in future financial freedom. Self-Help offers high-yield term certificates that can provide a cushion for unexpected expenses, as well as financial

security. And your deposit dollars support our mission of creating economic opportunity for low-wealth families and communities.

Learn more about our term certificates here.