Self-Help loan officer Vanessa Akans (left) and borrower Ronald Pauline (right)

Sometimes even our best plans get thrown off course, but owning your own home remains the best way to ensure financial stability and build sustainable wealth. With National Homeownership Month upon us, we’re highlighting stories about homeowners around our footprint, like Mr. Ronald Pauline of Jacksonville, Florida, who demonstrate both the challenges and immense rewards of the entire homeownership journey.

When Ronald Pauline learned that his home needed some costly major repairs, he came to Self-Help’s Kendall branch to find out how he could obtain financing. Originally from Minnesota, Mr. Pauline has been a resident of the Jacksonville area for over 20 years and a member of Jax Metro/Self-Help Credit Union for almost as long.

As a veteran and retired accountant on a fixed income, Mr. Pauline knew it would be difficult to come up with cash for his home’s repairs. He worked with Self-Help’s mortgage team to explore the available options and make sure his finances were in order, he decided to refinance his home.

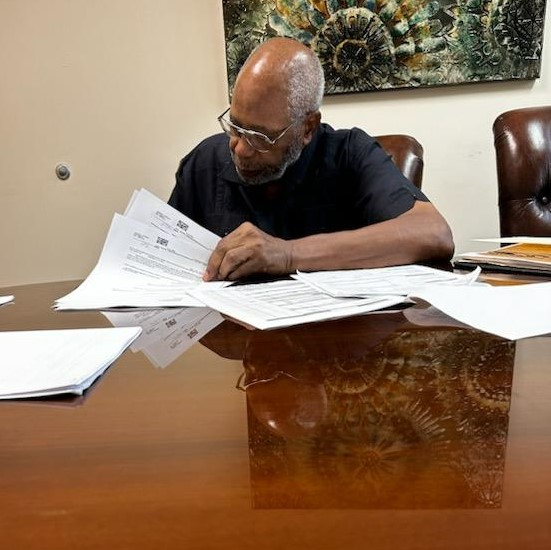

Mr. Pauline closing on his loan

Self-Help loan officer Vanessa Akans and Mr. Pauline created a step-by-step plan to get approved for the refinance, including our Equity Boost product, which resulted in a much lower interest rate than Mr. Pauline expected.

Not long after, Mr. Pauline was able to close on this loan and plan the necessary repairs to his home. His home is now back in great condition, giving him more time to engage in his passion for gardening.

If you’re a homeowner and interested in learning more about how we can help you secure financing for updates to your home, you can learn more here. If you’re considering purchasing a home, check out our resources for first-time homebuyers.