Trying to fight climate change as an individual can be daunting. Actions like recycling and composting are helpful, but they often feel like a drop in the ocean. However, by choosing to partner with a financial institution committed to investing in a more sustainable planet, you can significantly amplify your impact.

What We’re Doing for Sustainability

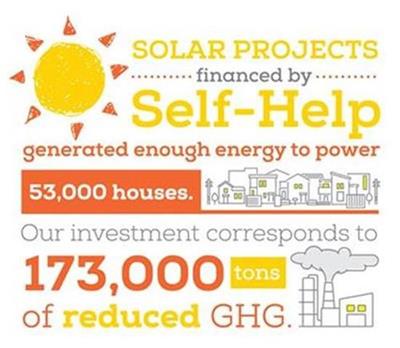

- Sustainability is a cornerstone of Self-Help’s business activities and investments, not only during Earth Month but all year round. Unlike many financial institutions, Self-Help does not finance fossil fuel projects, and we build sustainable practices into our daily operations. This means that the money you deposit isn’t helping to build pipelines or pollute the environment.

- We have a strong track record of loans to businesses and nonprofits dedicated to sustainable development, and all our lending focuses on low-wealth communities.

- We also build sustainability into Self-Help’s real estate development projects by using rigorous energy efficiency and sustainability practices in both new and renovated buildings.

Working for More Accountability Among Financial Institutions

Recently, Self-Help expanded our commitment by joining a global effort to help financial institutions become more accountable for fighting climate change. Specifically, the Partnership for Carbon Accounting Financials was formed “to measure and disclose the greenhouse gas emissions financed by loans and investments.”

This is a voluntary effort, and Self-Help was among the first financial institutions that pledged to benchmark our loan portfolio under the new carbon accounting standards. Self-Help’s early adoption also helped ensure that the new accounting practices would be feasible for smaller community development financial institutions and credit unions, as we helped develop a guide to implementing PCAF’s accounting methods.

Because greenhouse gases (GHG) – typically generated through burning fossil fuels, clearing forests, and agriculture – are a major component of human-driven climate change, we at Self-Help feel duty-bound to inform our members and the public of how much GHG we generate and what we’re doing to reduce our emissions. Unlike Self-Help, many financial institutions contribute to the generation of GHGs through their loans and investments in fossil fuel companies and industries that continue and increase the burning of fossil fuels and warming of the climate.

To better understand our part in the effort to fight climate change, Self-Help’s sustainability team looked at our lending portfolio as well as three main categories of GHG emissions that Self-Help generates through our operations: direct emissions from Self-Help-owned buildings and vehicles, indirect emissions from energy Self-Help uses but doesn’t produce (like electricity from utilities), and indirect operational emissions, such as employee commuting. We will use these data to prioritize investments to reduce our GHG footprint with actions such as installing rooftop solar on our buildings and employee education campaigns. Read the summary report here.

We invite you to take part by supporting our work through a Green Term Certificate, which offers competitive interest rates and is federally insured.

Our Sustainability Director Melissa Malkin-Weber notes that our Green Term CDs have been an important way for Self-Help to align our values with those of our members:

“When our members invest in Green Term CDs, they fuel our efforts to expand Self-Help’s green lending. We’re proud of our track record, investing $409M in environmentally sustainable projects, businesses and nonprofits. The rapid pace of climate change has only added urgency to that work.”

And if you’re not currently a Self-Help member and you care about protecting the environment, please consider joining us! Member deposits help support this work as well as our broader mission of expanding economic opportunity for all.