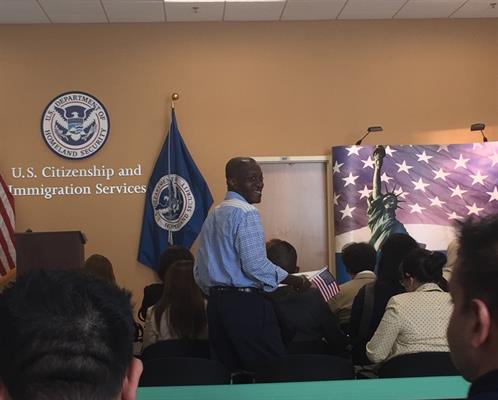

Credit Builder borrower Aubert Semon takes Oath of Allegiance during 2018 Naturalization Ceremony.

Increasing your credit score is the first step for many borrowers hoping to qualify for loans to buy homes or start a new business. It's easy to get mired in debt, and it can be hard to get out. At Self-Help Credit Union, we offer a Credit Builder loan that helps members establish or build stronger credit while building savings too.

One of our members, Aubert Semon, is among many who have benefited from a Credit Builder loan. Recently Aubert agreed to talk about his experience with Stephanie Diane Ford, who works on Self-Help's communications team.

Q: How did you hear about Credit Builder?

A: I asked friends about building credit and went online and found out about Credit Builder Loans at Self-Help [Credit Union]. I called and was referred to Kari Presley, a Self-Help [Credit Union] loan officer in Durham.

Q: What did you use the service for?

A: I needed to improve my credit score to qualify for a business loan. I set up the company in September 2017. We deal with international trade shipping corn, rice and other commodities internationally.

Q: What was your financial situation before using Credit Builder?

A: I didn't have a job for three years. I started a new job, and I wasn't looking for a loan or credit but knew something was wrong. When I decided to start my company, I knew the Credit Builder loan was my first step.

Q: Did you try to get a loan elsewhere?

A: Yes, I was denied by another institution.

Q: Describe your experience joining Self-Help Credit Union and using the Credit Builder Loan.

A: I was so amazed. Kari was straight to the point explaining what I had to do and the commitment it would take. I thought I was on my own, but six months after I started Kari sent a congrats email. It was good receiving the email because it kept me motivated.

Q: What were the results of completing the program?

A: I didn't know what my credit score was, but I knew it wasn't good. After the program, it went really high—over 750. I obtained the business loan about two months after paying off the Credit Builder loan.

Q: What are the possibilities for you now?

A: I can keep growing my company, keep credit in check and bank with Self-Help [Credit Union]. A one-year commitment with Credit Builder will give you a second chance at life. I will recommend it to anybody.

To apply for a Credit Builder loan, please contact or visit your local branch.