For opponents of predatory lending, last Thursday was a red-letter day. On October 5 the Consumer Financial Protection Bureau (CFPB) issued a new rule aimed at reducing the harms of predatory payday and car-title loans—usually short-term loans with extremely high interest rates. These loans are peddled as a lifeline, but in reality they drown cash-strapped consumers in debt.

In a national teleconference hosted by half a dozen consumer and civil rights groups, Mike Calhoun, president of our affiliate, the Center for Responsible Lending (CRL), said “These high-cost predatory loans are financial booby traps… This rule is an important milestone in providing working families with reasonable financial products.”

If you’re not familiar with payday loans, consider yourself fortunate. These loans, often due in two weeks, come with interest rates of about 400 percent. They are designed to force repeat loans—an average of eight times before the loan is paid off. This debt trap is the core of the payday and car title loan business model.

CFPB data shows that 75% of all payday loan fees are generated from borrowers stuck in more than 10 loans a year. Eighty-five percent of car title loans follow within 30 days of a previous car title loan, meaning that the large majority of car title loan volume is driven by previous unaffordable car title loans.

The new CFPB rule incorporates the common-sense requirement that lenders check a borrower’s ability to repay before lending money. However, consumer advocates are disappointed that the rule permits six short-term payday loans a year to be exempt from the prescribed underwriting standards. Appropriately, car title loans cannot use this exemption. You can find more details on this fact sheet created by CRL and other advocates.

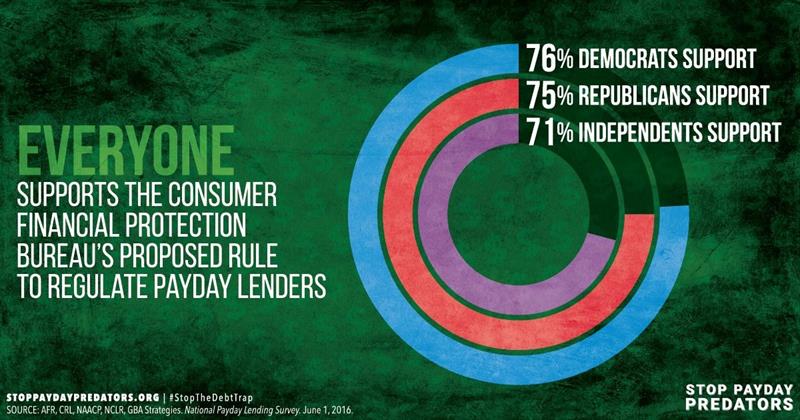

Payday loans are not popular. As shown in the graphic below, a survey conducted last year revealed hefty bipartisan support for the CFPB’s preliminary rules. In fact, during the rulemaking process the CFPB received nearly half a million comments calling for protections that stop payday lenders from preying on families.

As CRL and other allies point out, this is not the end of the fight against predatory lending. In recent times unscrupulous lenders have been migrating toward harmful longer-term loans. CRL and allies are calling on the CFPB to issue rules covering those loans, too. In addition, consumer advocates are urging members of Congress and state policymakers to protect this new rule and to help keep strong state rules in place. For example, fifteen states and the District of Columbia already have a 36% APR (annual percentage rate) limit on high-cost installment loans.