June is National Homeownership Month, an occasion well worth celebrating. That’s because families who own homes are able to acquire wealth, not just income. According to a 2014 Federal Reserve study, homeowners, on average, have a median net worth that is 36 times greater than renters--$195,400 for owners versus $5,400 for families that rent. Owning a home remains America’s best and

most reliable path to economic opportunity.

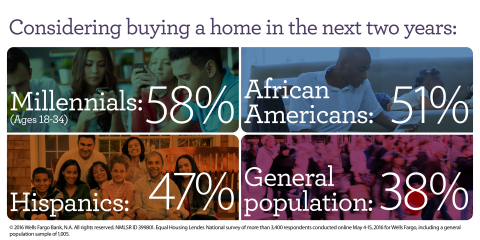

Last week Wells Fargo published highlights from its annual survey “How America Views Homeownership.” Even in the wake of the

housing crisis, the survey shows that the overwhelming majority of Americans consider homeownership to be an achievement and “a dream come true.” Many respondents, especially millennials, are considering buying a home in the next

two years:

Today Self-Help is working in partnership with Wells Fargo and Bank of America to make homeownership possible for more families.

The banks are offering an affordable mortgage with a down payment requirement as low as three percent. Self-Help backs these loans with our own credit guarantee. We’re willing to do that because our experience shows that low down payment

mortgages, when responsibly underwritten, are a win-win for everyone involved.

More than 30 years of mortgage lending has proven to us that families don’t need a high income to be successful homeowners. If they have been responsible paying their bills and—very important—have an opportunity to get a fair mortgage,

these families are great home buyers. We’ve seen it again and again.

If you’d like to find out more about how to apply for a mortgage with a low down payment, contact one of our partner banks directly:

Bank of America - Affordable Loan Solution™ 1.866.466.0979

Wells Fargo - yourFirstMortgage™ 1.877.937.9357